Payroll 2023 calculator

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Salary Tax Calculator For Pakistan 2021 Excel Model For Salary Calculation In One Second Youtube

Get Started With ADP Payroll.

. In 2023 these deductions. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business.

Learn More About Our Payroll Options. Ad Process Payroll Faster Easier With ADP Payroll. Make Your Payroll Effortless and Focus on What really Matters.

The EX-IV rate will be increased to 176300. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. We hope these calculators are useful to you.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. Ad Compare 5 Best Payroll Services Find the Best Rates. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which.

All Services Backed by Tax Guarantee. Check your National Insurance payroll calculations. Under 65 Between 65 and 75 Over 75.

Ad Payroll So Easy You Can Set It Up Run It Yourself. 2 2022 The presidents alternative pay plan is an across. You must ensure that they are receiving the correct amount of money and all deductions taken from their pay.

Simplify Your Employee Reimbursement Processes. Try out the take-home calculator choose the 202223 tax year and see how it affects. Payroll calculator 2023 Senin 19 September 2022 Edit.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Ad Compare 5 Best Payroll Services Find the Best Rates. It will confirm the deductions you include on your.

When you choose SurePayroll to handle your small business payroll. 2021 Tax Calculator. Subtract 12900 for Married otherwise.

Prepare and e-File your. Prepare and e-File your. Start the TAXstimator Then select your IRS Tax Return Filing.

News for 2023 GS Pay Scale. Sage Income Tax Calculator. 2023 Paid Family Leave Payroll Deduction Calculator.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Every employee of your company should feel safe. See where that hard-earned money goes - with UK income tax National Insurance student.

Plug in the amount of money youd like to take home. 2022 San Diego Padres MLB playroll with player contracts options and future payroll commitments. If payroll is too time consuming for you to handle were here to help you out.

White House Formalizes Average 46 Pay Raise for Federal Employees in 2023. Daily Weekly Monthly Yearly. The maximum an employee will pay in 2022 is 911400.

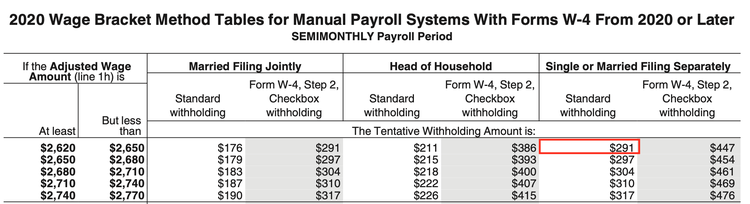

All Services Backed by Tax Guarantee. Simplify Your Employee Reimbursement Processes. A 2020 or later W4 is required for all new employees.

2022 Federal income tax withholding calculation. Get Started With ADP Payroll. 2023 Tax Calculator 01 March 2022 - 28 February 2023 Parameters.

Make Your Payroll Effortless and Focus on What really Matters. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax. FAQ Blog Calculators Students Logbook.

5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Free Unbiased Reviews Top Picks.

Ad See How MT Payroll Services Can Help Streamline And Grow Your Business. Learn More About Our Payroll Options. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More. The standard FUTA tax rate is 6 so your max.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Payroll withholding calculator 2023 Senin 12 September 2022 Edit. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. The US Salary Calculator is updated for 202223. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Enter up to six different hourly rates to estimate after-tax wages for hourly employees. It will be updated with 2023 tax year data as soon the data is available from the IRS. The payroll tax rate reverted.

It will be updated with 2023 tax year data as soon the data is available from the IRS.

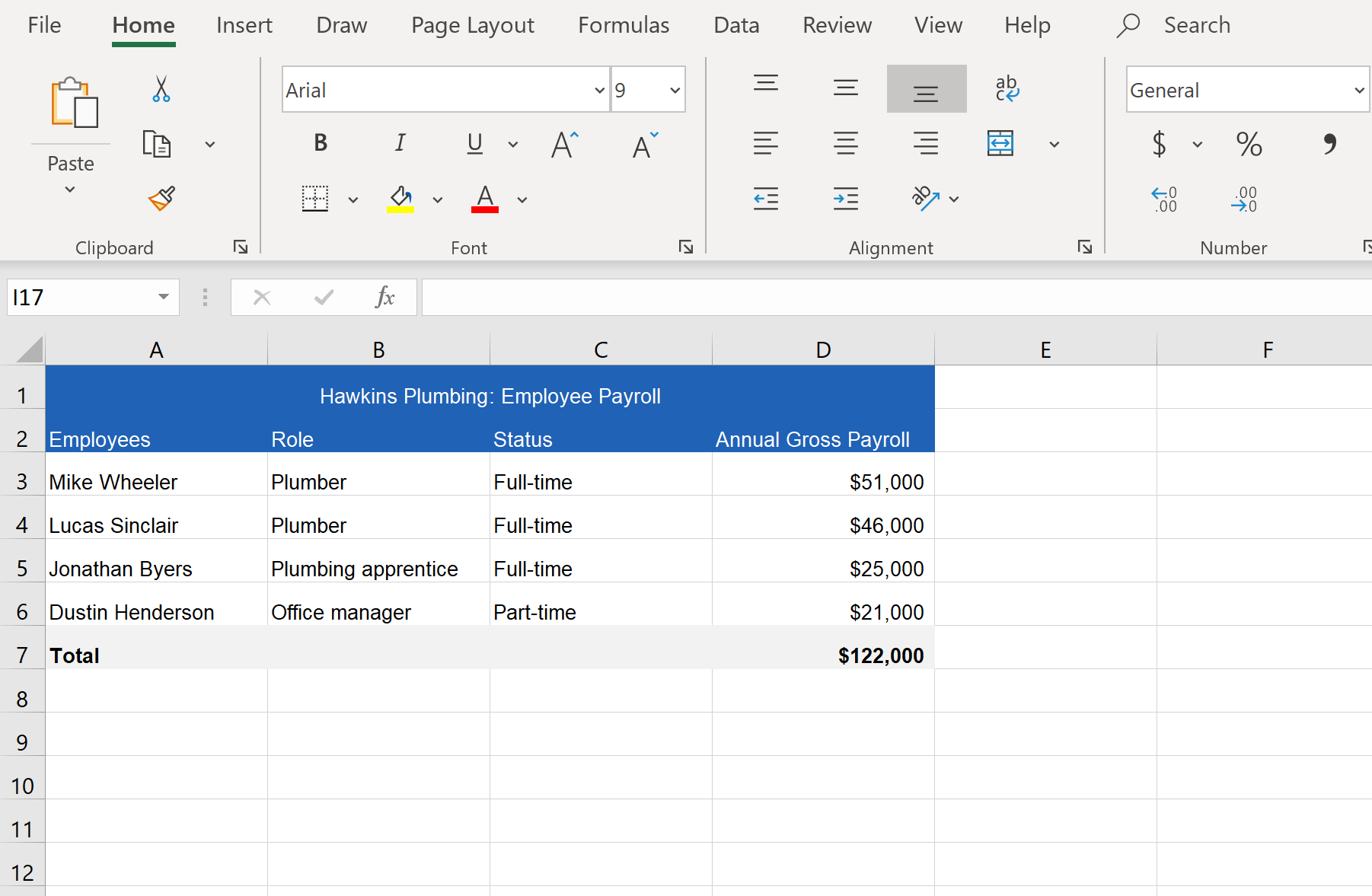

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Time Management Worksheet

Workers Compensation Payroll Calculation How To Get It Right

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

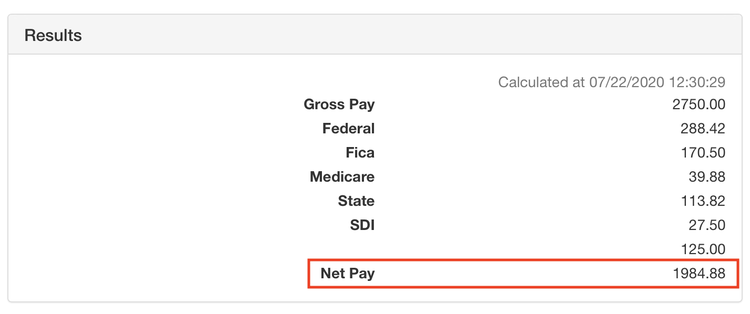

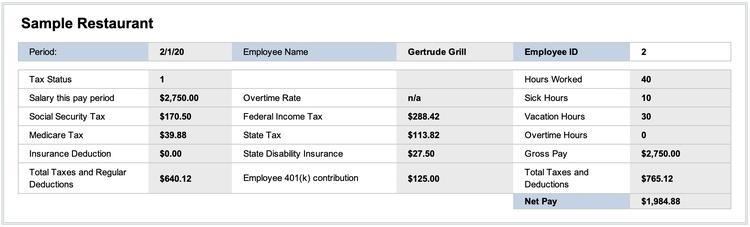

A Small Business Guide To Doing Manual Payroll

Calculator And Estimator For 2023 Returns W 4 During 2022

Salary And Tax Deductions Calculator The Accountancy Partnership

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Newsroom Accace Outsourcing And Advisory Services

Calculator And Estimator For 2023 Returns W 4 During 2022

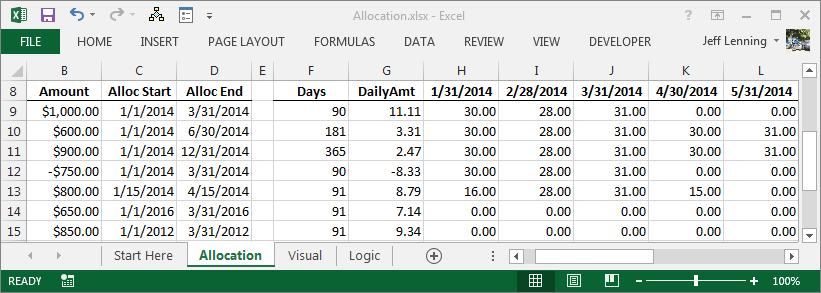

Excel Formula To Allocate An Amount Into Monthly Columns Excel University

2020 Payroll Calendar Adp Canada

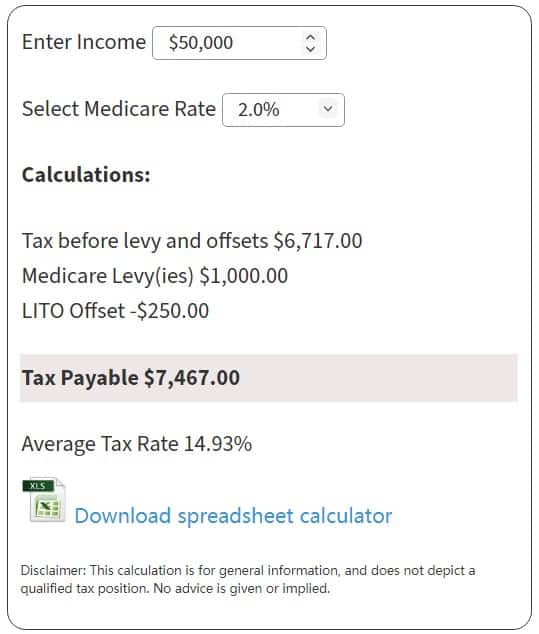

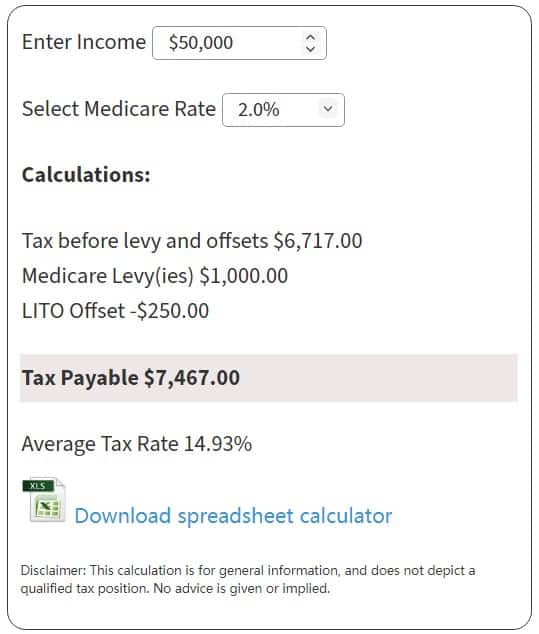

Australian Tax Rates 2022 2023 Year Residents Atotaxrates Info

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

A Small Business Guide To Doing Manual Payroll

A Small Business Guide To Doing Manual Payroll

German Payroll Example For 55000 55k Income Ta

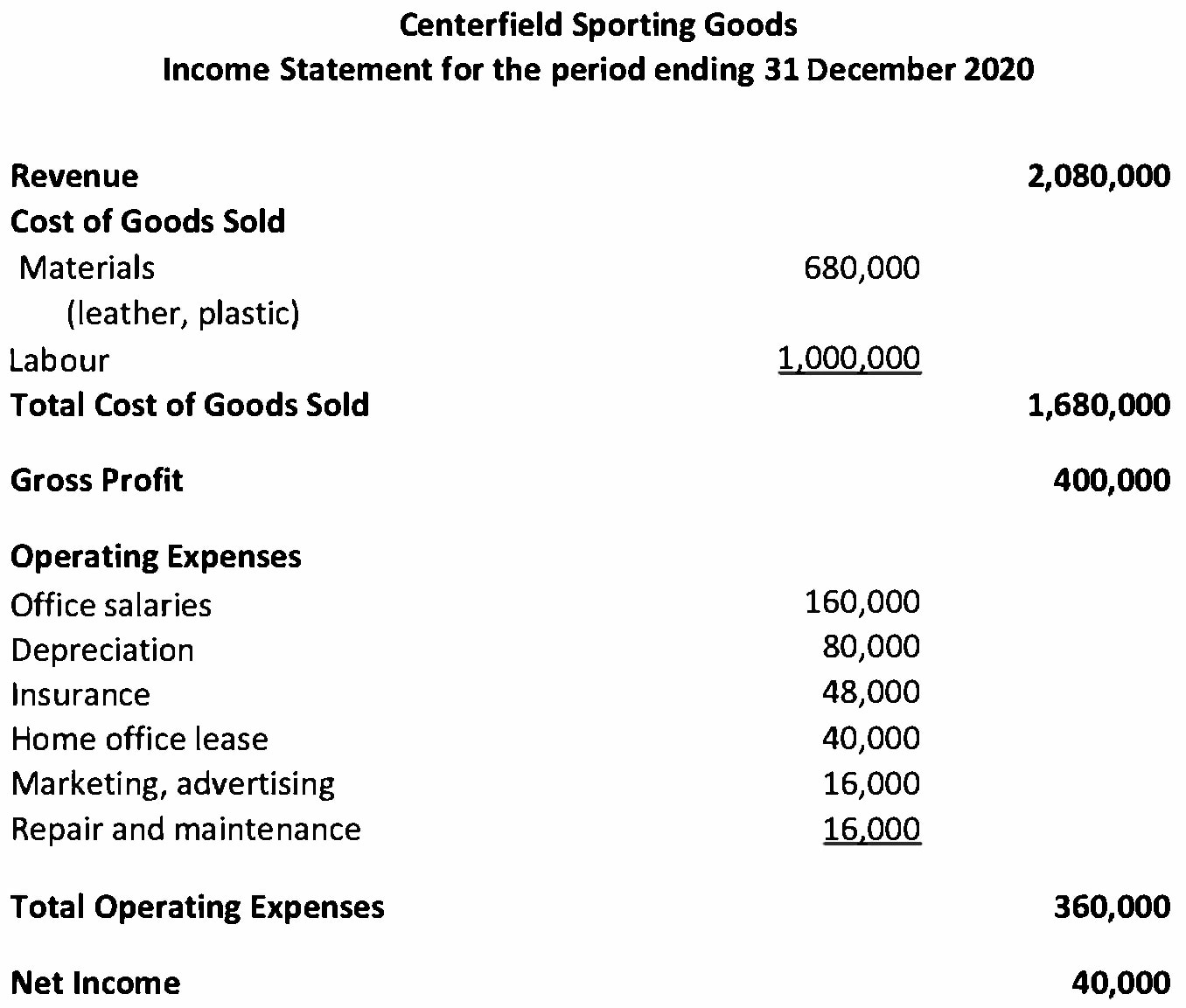

What Is Gross Margin And How To Calculate It Article